Value Line Timeliness™ High Dividend SMA

Participate in the income potential of high dividend U.S. companies with strong near-term capital appreciation potential. The Value Line Timeliness High Dividend SMA invests in companies with high dividend yields and high scores on the Value Line® Timeliness™ ranking system.

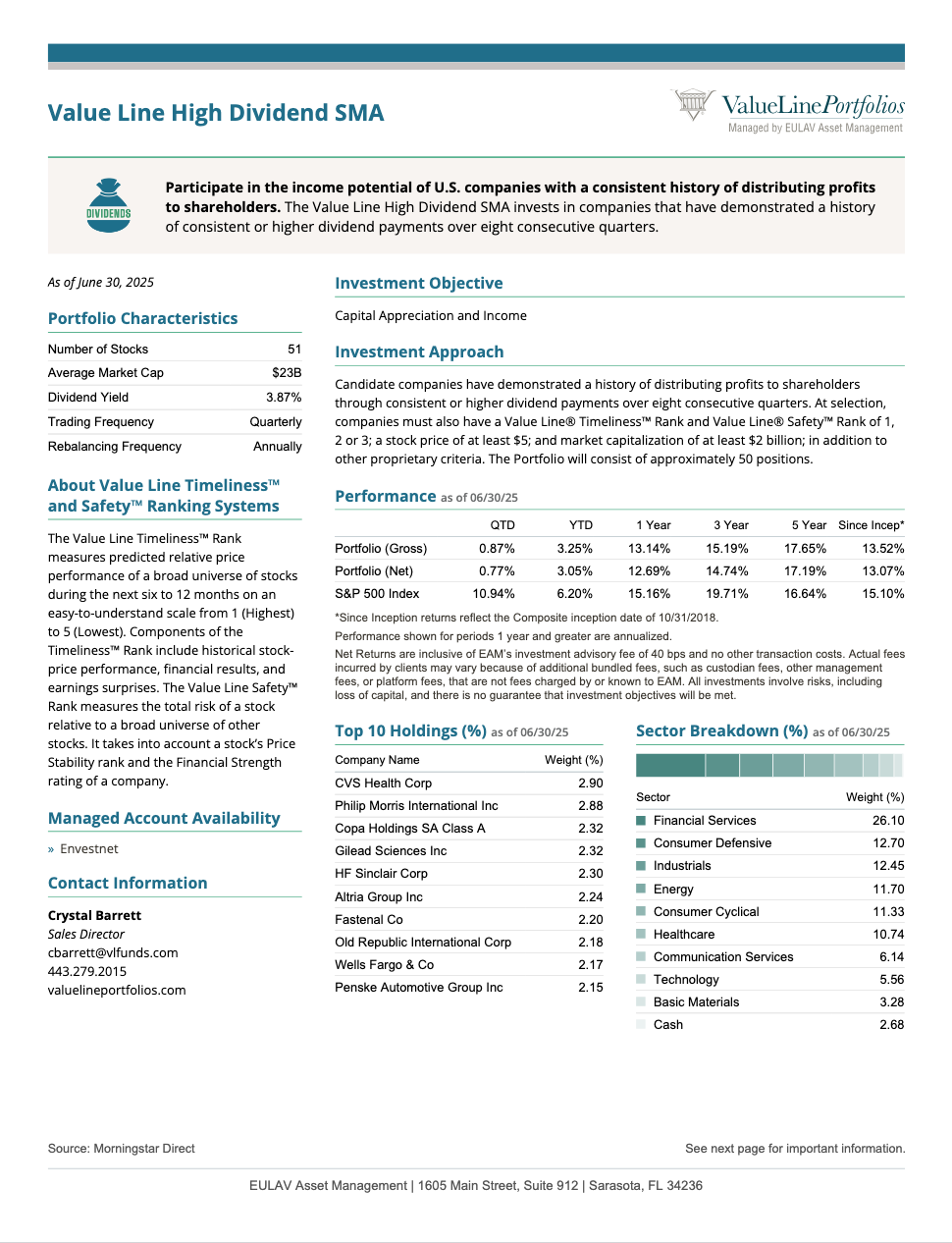

Investment Objective

Capital Appreciation and Income

Portfolio Characteristics

| Characteristic | Value |

|---|---|

| Number of Stocks | 48 |

| Average Market Cap | $88B |

| Dividend Yield | 2.96% |

| Trading Frequency | Monthly |

| Rebalancing Frequency | Monthly |

Investment Approach

Higher dividends demonstrate a commitment to distributing profits to shareholders as well as business optimism on the part of management. To be included in the portfolio’s selection universe a stock must be U.S.-based and have a market capitalization of at least $10B. Holdings are selected and weighted using a multi-factor risk model and optimizer software to achieve a balance between high scores on Timeliness, high dividend yields, and portfolio risk taken relative to a large cap value index. The portfolio is generally rebalanced monthly and targets between 50 and 70 holdings in total.

How Stocks Are Selected

The Portfolio will consist primarily of stocks meeting the following criteria:

- Stocks based in the U.S.

- Market capitalization at least $10B

- Higher dividend yield

- A multi-factor risk model is used to balance Value Line® Timeliness™ scores, high dividend yield and portfolio risk

- The Portfolio generally consists of 50-70 stocks

- Portfolio is traded monthly

Top 10 Holdings (%) as of 12/31/25

| Company Name | Weight (%) |

|---|---|

| Alphabet Inc Class C | 5.04% |

| Bristol-Myers Squibb Co | 4.04% |

| General Motors Co | 3.93% |

| Ford Motor Co | 3.82% |

| Johnson & Johnson | 3.74% |

| Lam Research Corp | 3.66% |

| Verizon Communications Inc | 3.61% |

| The Goldman Sachs Group Inc | 3.57% |

| The Hartford Insurance Group Inc | 3.51% |

| Lamar Advertising Co Class A | 3.29% |

Performance as of 12/31/25

Sector Distribution as of 12/31/25

| Sector | Weight | |

|---|---|---|

| Healthcare | 19.20% | |

| Financial Services | 16.06% | |

| Communication Services | 15.09% | |

| Technology | 13.66% | |

| Industrials | 12.76% | |

| Consumer Cyclical | 11.48% | |

| Real Estate | 4.13% | |

| Consumer Defensive | 3.43% | |

| Energy | 3.06% | |

| Cash | 2.21% | |

| Basic Materials | 1.13% |

Source: Morningstar Direct